green card exit tax irs

Web The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. The code section is.

Does The Us Have An Exit Tax Us Tax Help

When a person is a covered expatriate it means they may be subject to exit tax depending on what their mark-to.

. Web It does not matter whether they are residing in the United States or not because the time period is based on the green card status not time living in the US. 2 IRC 877 Expatriation to Avoid Tax. Web In June 2008 Congress enacted the so-called exit tax provisions under Internal Revenue Code Section 877A which applies to certain US.

Person Green Card Holder to be a permanent resident for eight full years. Web IRC 877 Expatriation to Avoid Tax when Giving Up a Green Card. Web Its a little different for Green Card Holders if youre considered a long-term resident or Green Card holder for 8 of the past 15 years you could be subject to the exit.

Citizens Green Card Holders may become subject to Exit tax when relinquishing their. Rather the way the code is written presumes that as long as the. Web Long-term green card holders may be subject to exit tax if they relinquish their green cards after being a lawful permanent resident for at least 8 years.

Web For calendar year 2022 an individual is a covered expatriate if the individuals average annual net income tax for the five taxable years ending before the expatriation. Web You are a resident for US. Web Surrendering a Green Card US Tax Rules for LTRs.

Web Attach your initial Form 8854 to your income tax return Form 1040 1040-SR or 1040-NR for the year that includes your expatriation date and file your return by the due date of. Web To trigger the exit tax the IRS must classify you as a covered expatriate. 3 IRC 877A Tax Responsibilities at Expatriation US Exit Tax 4 Form 8854 Initial and Annual.

Exit tax is not charged out of mean-spiritedness or as a final grab at your personal assets. This is known as the. For Green Card holders to be subject to the exit tax they must have been a lawful.

The Exit Tax Planning rules in the United States are complex. Web 1 US Exit Tax Giving Up a Green Card. Web The tax code does not require a US.

Web Net worth one common way that people get hit with the green card exit tax is by having a net worth exceeding 2 million at the time that you lose your status. Web Exit Tax Planning. The purpose of IRC 877 is to define who may be subject to exit tax at the time of expatriation.

Federal tax purposes if you are a lawful permanent resident of the United States at any time during the calendar year. Web Why does exit tax exist. Instead exit tax is an attempt by the US government to.

Currently net capital gains can be taxed as high. Web However once a green card holder meets the 815 year test defining an LTR there is ongoing potential exit tax and inheritance tax exposure on relinquishing green card. Web For people who currently have green cards the only way to avoid the exit tax is to avoid the in 8 of the last 15 years rule that converts them from merely resident to.

Tax Advice For Expatriation Giving Up Your Green Card Or Your U S Citizenship Part I Los Angeles Offshore Banking Lawyer Dennis Brager

How To Make Irs Payments For Your Taxes Tax Defense Network

Irs Keeping Free File Open Through Thursday Kxan Austin

Green Card Abandonment U S Tax Expatriation Exit Tax Fbar Fatca Forms 3520 5471 And 8938 Youtube

15 Common Questions About Expatriation Form 8854 And The Exit Tax Answered By A Cpa O G Tax And Accounting

Tax Tip Notice From Irs Something Is Wrong With 2021 Tax Return Tas

Lawful Permanent Residents Tax Expatriation

Irs Cracks Down On Net Worth Declarations In Expatriation Filings Wealth Management

Irs Tax Return Request Process Information Financial Aid

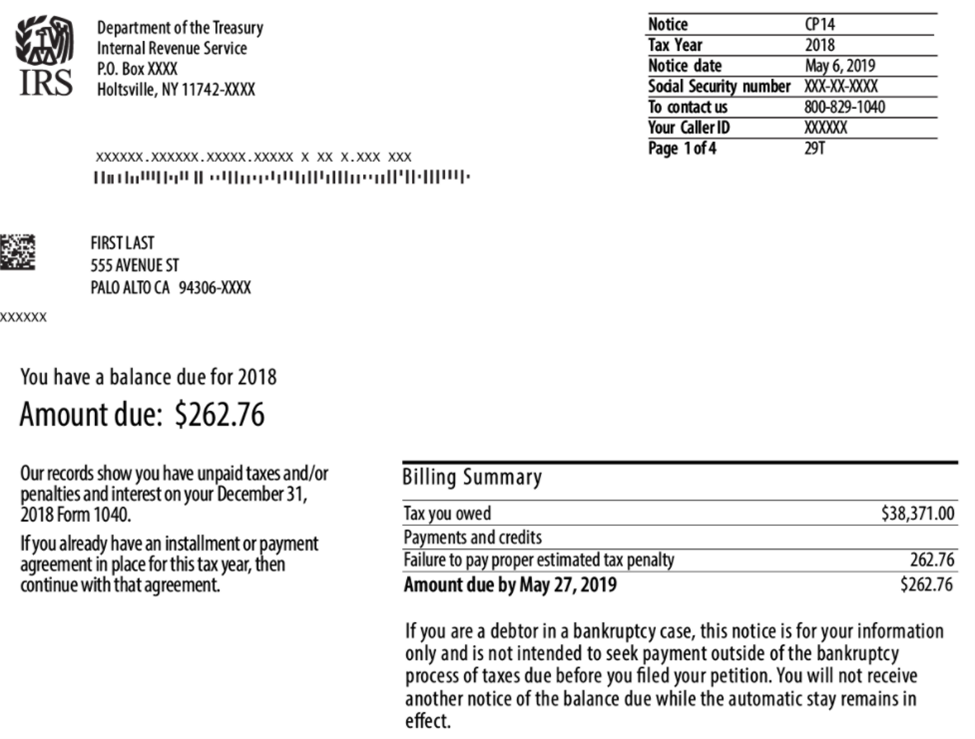

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group

How To Handle Dual Residents Irs Tiebreakers Htj Tax

United States Giving Up Green Card Or Us Citizenship Here Are Your Tax Consequences The Economic Times

Oops Am I An American Response From The Irs

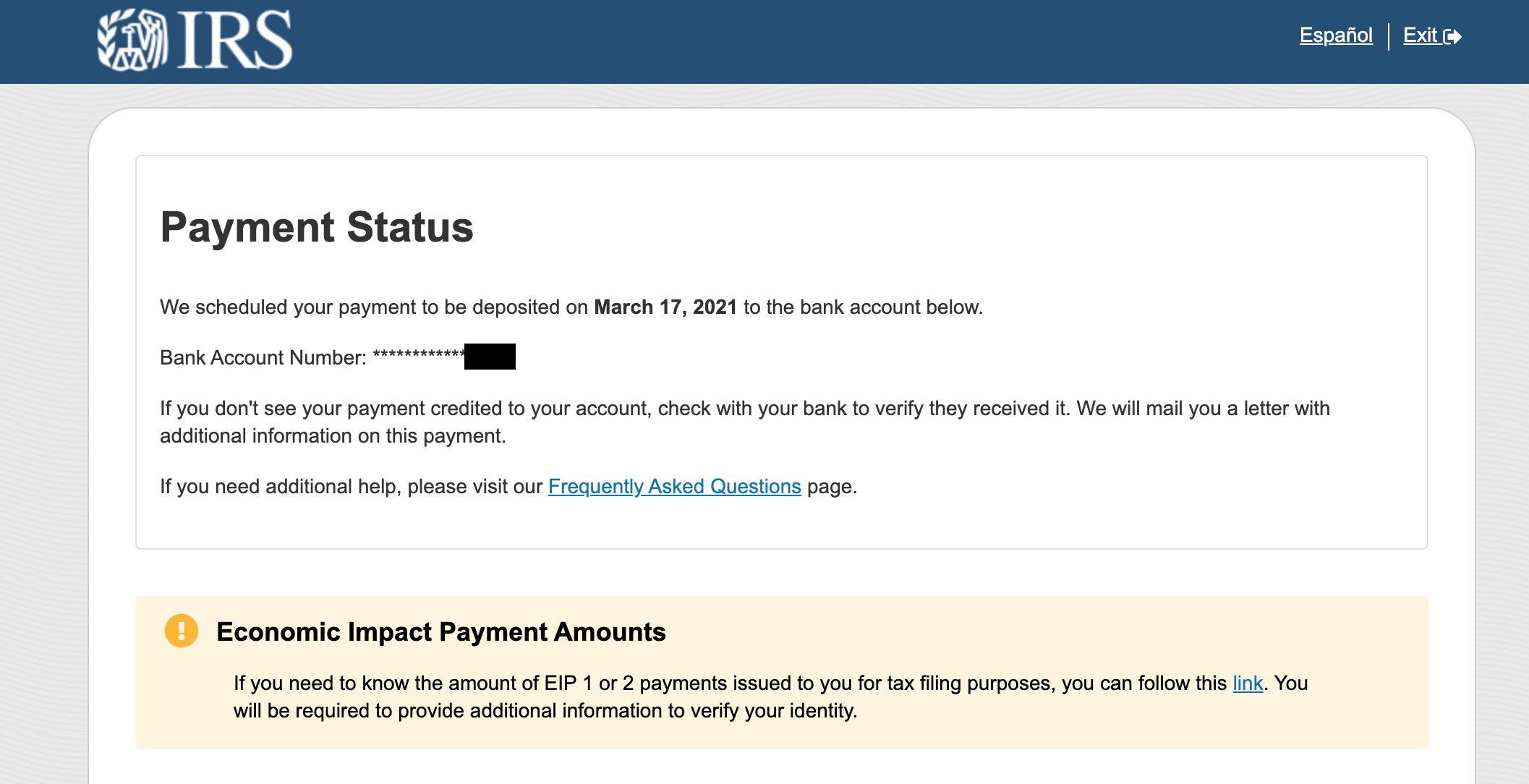

3rd Stimulus Check Update Irs Updates Get My Payment Tool See When You Ll Get Paid Syracuse Com

U S Exit Tax Orlando International Tax Lawyer

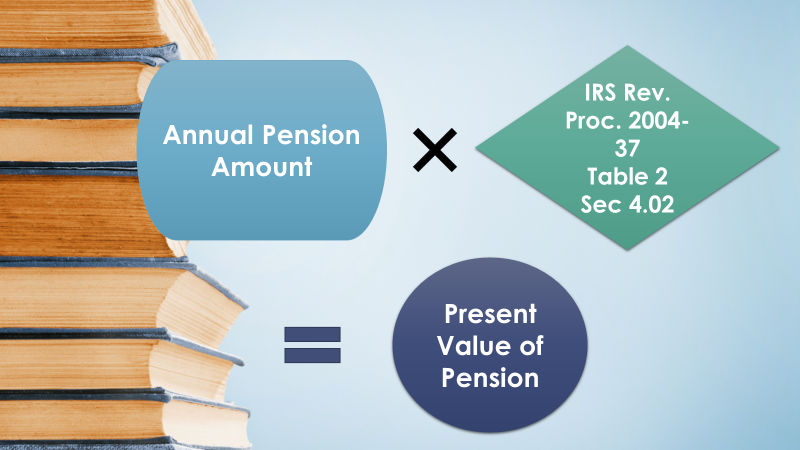

Valuation Of Defined Benefit Pension Plan In Exit Tax Cdh

Expatriation Exit Tax Planning Attorneys Castro Co

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group